We recently had the chance to catch up with John Ochs – Managing Director, APM Terminals Pier 400, which handles approximately 1.6 million TEU and is the largest single proprietary terminal in the world. With a total of 484 acres, APM can accommodate 8,000 wheeled and 17,000 grounded containers.

We asked John about Pier 400’s recently rolled out appointment system, how things have been going for APM this year and how 2011 is looking for the terminals at the Ports of Los Angeles and Long Beach.

Here’s what he had to say:

PierPASS: Why did you decide to roll out an appointment system earlier this year at Pier 400?

John: The TermPoint system allows us to better understand what volume of drayage truckers to expect on any given shift. We can then adjust our labor order to provide the appropriate number of equipment operators to service the truckers. Additionally, an appointment system allows us to distribute the volume of drivers throughout the entire shift. The result is a reduction of queue time, as there is not a surge of truckers attempting to get serviced at the start of the shift.

PierPASS: How does the appointment system work and how does it affect the truckers coming through your terminal?

John: The system allows trucking companies to make appointments once containers are discharged. The effect on the trucking community is the need to monitor their containers and plan their deliveries to ensure they secure appointment times that best meet their business needs. Our system has been well received by the trucking community and, since the implementation, our data has shown reduced turntimes, which is a huge benefit to truckers using Pier 400.

PierPASS: How will the appointment system increase efficiency at APM?

John: Again, the appointment system provides us the visibility of what volume/activity to expect. The system also provides us the ability to know where to position our CHE (container handling equipment), therefore providing efficient and timely service throughout the shift.

PierPASS: What other measures have you implemented this year to handle increased traffic in your terminal?

John: We have reallocated the use of our truck gates to better segregate truck traffic for import and exports.

PierPASS: What is your outlook for 2011?

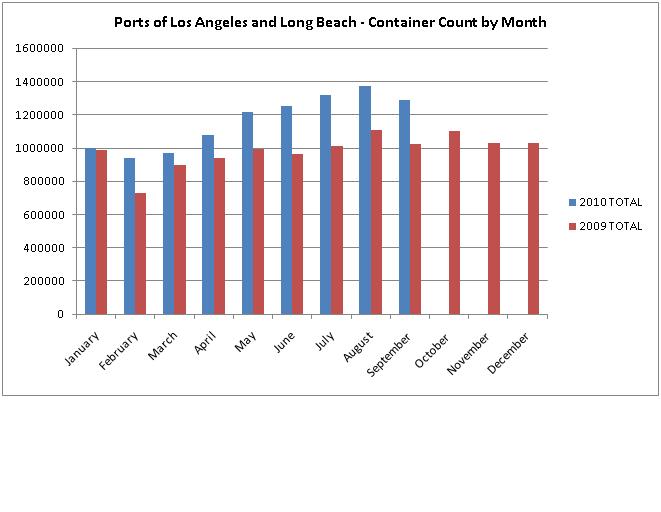

John: The cargo volume forecast for the first quarter is relatively stable, and Chinese New Year is early this year. The entire industry is awaiting the forecast for the second quarter with great anticipation.