From: Bruce Wargo, President and CEO, PierPass Inc.

As someone involved with or interested in the Ports of Los Angeles and Long Beach, I believe you will want to know about efforts underway that could raise the cost of moving cargo through these ports.

Within our existing Peak and OffPeak shifts, there is plenty of available capacity for additional cargo. During the second half of the OffPeak shift (11:00 p.m. to 3:00 a.m.), many terminals are seeing very little volume, and volumes are also often light during weekday mornings.

Nonetheless, certain trucking interests and their allies have called for mandating terminal gates at the Ports of Los Angeles and Long Beach to remain open 24 hours a day, seven days a week, and want to impose penalties on terminals when turn times exceed a threshold.

The terminal operators believe these efforts are based on both faulty data and a failure to face the real problems with harbor trucking. In an effort to cut through to the truth, I wrote an opinion piece I wrote that was published Friday in the Journal of Commerce.

The article can be viewed here http://goo.gl/XRe3tB (requires JOC registration), and I’ve pasted a copy below.

Regards,

Bruce Wargo

It’s Time to Face the Real Problems with Port Trucking

Bruce Wargo | Jan 24, 2014 10:00AM EST

Published on JOC (https://www.joc.com)

Like death and taxes, it seems certain that wrangling between trucking companies and marine terminals over truck turn times will always be with us.

Trucking interests and their allies have called for mandating terminal gates at the Ports of Los Angeles and Long Beach to remain open 24 hours a day, seven days a week, and want to impose penalties on terminals when turn times exceed a threshold. These efforts are misguided, based on both faulty data and a failure to face the real problems with harbor trucking.

Imposing such measures would achieve precisely the opposite of the intended effect, by significantly increasing the cost of doing business at the Ports of Los Angeles and Long Beach, driving away discretionary cargo, and thus reducing revenue opportunity for drivers and trucking companies serving the ports.

The turn time issue is a diversion that lets the trucking industry remain in denial about the real problems – too many trucks for the current volume of cargo, and inefficient port trucking practices.

Truckers face a big challenge to their economic model, which was built around used trucks that cost $15,000. Now they have new $100,000 trucks mandated by California and port clean air rules, and it’s a challenge for them to cover that increased cost under the current harbor trucking model.

Some of them are trying to make the case that they can’t pay for their trucks because the marine terminal operators aren’t working hard enough. But reducing turn times by a few more minutes isn’t going to solve their problems.

Turn times – the amount of time it takes for a truck to pick up or deliver a container at a marine terminal –have little to do with how much money truckers earn from port drayage. The idea that truckers could move more containers and earn more money if turn times were faster is based on faulty logic. All import and export containers at the ports already are being picked up and delivered. There are no extra containers waiting to be moved.

There are roughly 30,000 container moves a day and 10,000 port trucks. There are only two ways to change the average number of moves port trucks do in a day: Attract more cargo, or reduce the number of trucks. It’s simple arithmetic.

As long as those numbers stay constant, it’s a zero-sum game for truckers. The only way one driver can do more turns is by taking turns away from another driver.

A Finger on the Scale?

The Harbor Trucking Association recently introduced its Truck Mobility Report, which measures turn times at the LA and Long Beach terminals. While we welcome efforts by third parties to track cargo movement, we believe it is crucial for policymakers to understand what the numbers represent. What they certainly don’t represent is a benchmark to build policy around.

Consider this: if a bank opens at 9:00 a.m. and you show up at 8:00 a.m., is it fair to complain about having to wait an hour for service? That is how the HTA is tracking data.

Under the HTA’s methodology, it starts counting waiting time well before the terminal gates open. In the afternoons, if a truck lines up at 4:30 p.m. for the OffPeak gates that open at 6:00 p.m., the wait is counted as starting at 5:00 p.m., according to the HTA’s description of its methodology. In the mornings, the HTA says it begins counting wait times at 6:00 a.m., two hours before the gates are scheduled to open.

Initial lines typically disperse quickly after the gates open at 8:00 a.m. While a truck arriving at 8:30 a.m. will often be able to drive right up to the gate, a truck arriving at 6:00 a.m. is guaranteed a minimum two-hour wait. It makes no sense to average those times together and portray it as a measure of terminal efficiency.

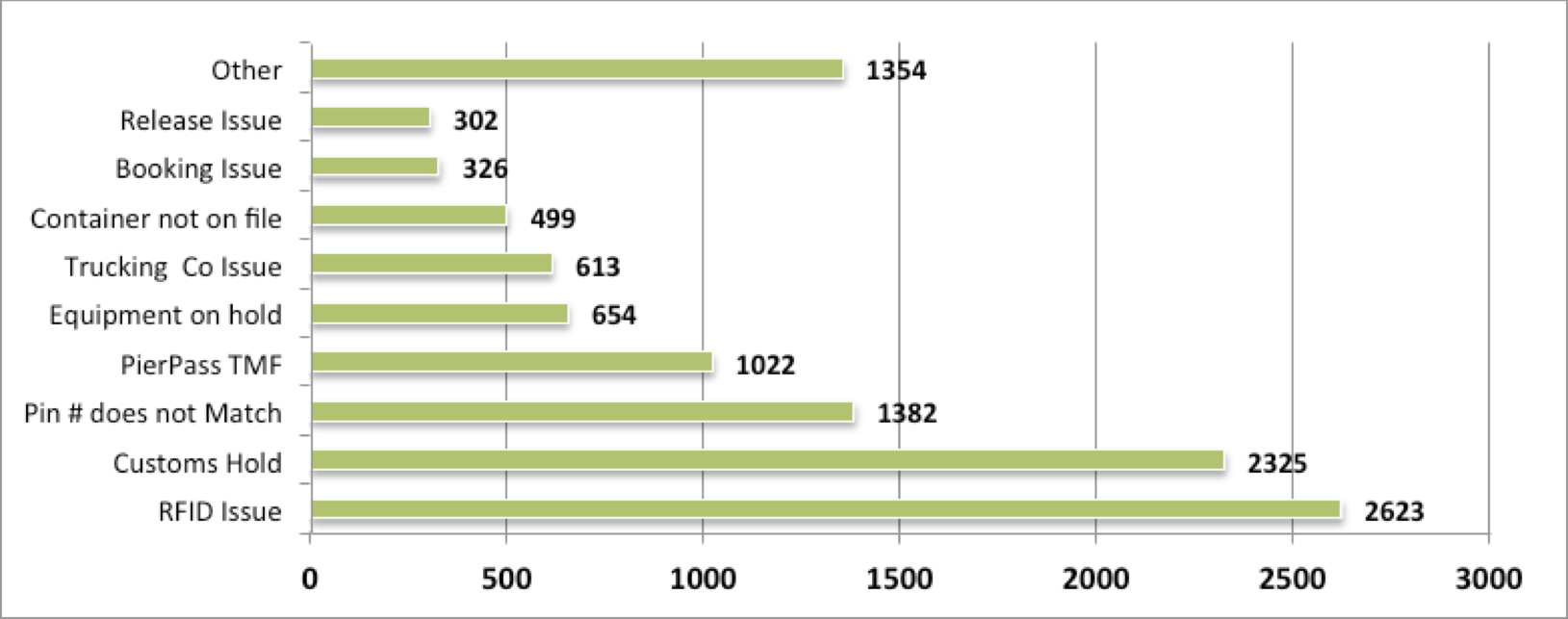

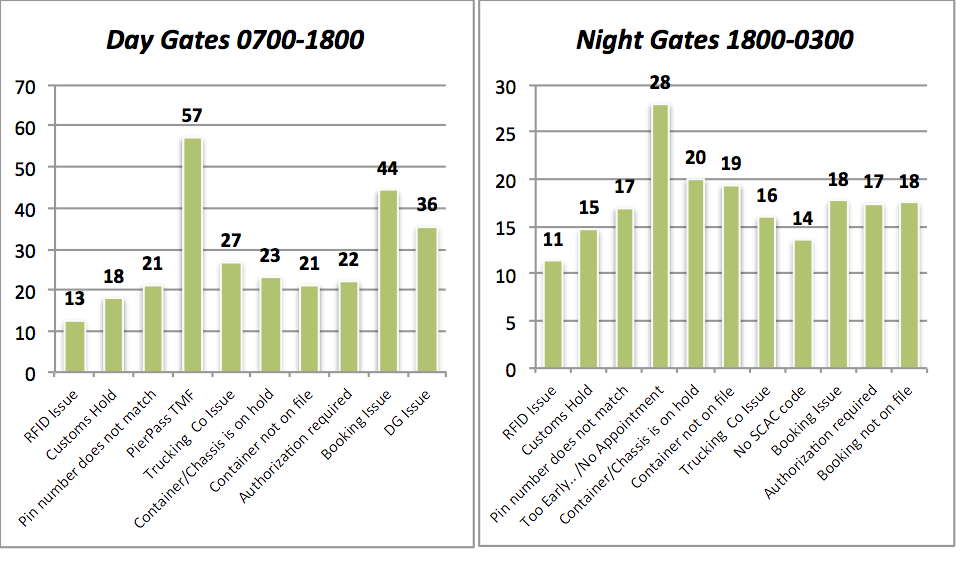

Trucking companies need to start taking more responsibility for their business practices. By refraining from sending trucks to the terminals long before the start of the daytime and OffPeak shifts, avoiding the contractually-mandated lunch hours, and taking simple steps to avoid trouble tickets, they can significantly reduce their average turn times.

How Long is Too Long?

A question no one has answered: How long should turn times be, and why?

Picking up an import container at a terminal isn’t like picking up a cheeseburger at a drive through. More than a dozen important issues need to be addressed in security, financial integrity and safety during the process. Many of these checks are required by the Federal government to protect security and enforce trade requirements and duties, while others are required by the terminal operators to ensure that valuable cargo goes to its rightful owners.

Container shipping is a complex interplay among a large group of independent parties – manufacturers, cargo owners, shipping lines, terminal operators, labor unions, truck owners, truck drivers, chassis leasing pools, warehouse owners, logistics companies, railroads and more – and actions by any of those groups can easily throw the whole system out of whack. A case in point is the unusual congestion experienced at the ports in late December and early January this year. Multiple factors converged – a large number of ships arriving at the same time, a shortage of skilled labor due to holidays, and disruptions in the chassis pool as shipping lines transfer chassis ownership to third-party fleet operators.

Cargo owners and terminal operators are already investing heavily to prevent gridlock in and around the ports. Since 2005, our marine terminal operators have worked together through PierPass to address congestion issues by running OffPeak shifts on nights and Saturdays. PierPass has been extremely successful in meeting the objective of reducing congestion. The OffPeak shifts have enabled the Ports to avoid a repeat of the gridlock that brought cargo to a standstill in 2004. About 55% of container moves now happen during the OffPeak shifts.

There is plenty of unused capacity at the terminals. In launching PierPass in 2005, the terminals nearly doubled the number of gate hours per week. Container volume was expected to grow rapidly to fill the new second shift, but by 2013 it was only slightly higher than it was in 2005. For the ports to mandate 24/7 operations at current cargo volumes would be financial suicide.

The OffPeak program, which cost $161 million in 2012, is partly funded by the Traffic Mitigation Fee charged on non-exempt containers using terminal gates during peak hours. TMF fees, paid by cargo owners, totaled $111 million in 2012. The terminal operators made up the difference and contributed an estimated $50 million on top of the TMF to pay for the cost of the second shift.

Like other business owners, terminal operators must decide every day how to operate most efficiently amid changing conditions – how much labor to hire and when to deploy it, the optimal hours of operation, and financially viable levels of service. For a governmental body to dictate such things is a recipe for inefficiency and higher costs for all.

Ultimately, it’s the cargo owners paying the bills to move their cargo through the ports. Financial levies on other industry participants will flow through to the cargo owners and drive away their business.

The marine terminal operators are already bearing the financial burden of improving the efficiency of port operations. More governmental interference will not help, and will more likely than not hurt those it was intended to benefit. The real problem facing harbor trucks is one of oversupply – too many trucks chasing a finite number of containers. If the trucking industry is not willing or able to reduce the number of port trucks, then the only real solution is to increase the number of containers moving through the ports. The last things the ports need right now are higher costs and less flexibility.

Bruce Wargo is president and CEO of PierPass, Inc.